Your receipt from the state for 2016 - check how your taxes are spent!

On 28 April 2017, we presented the "The Receipt from the State for 2016", our report providing clear and user-friendly information on the structure of our state's expenditures. Like every year, the sixth edition of this project took place just days before the tax filing deadline. Employees and volunteers of FOR gathered at the First Revenue Office in Warsaw to inform passers-by about state finances, distribute printed version of the bill and respond to questions.

The state spends more and more.

Civic Development Forum has been analyzing public expenditures for the last six years and presenting them, in an accessible way, as spending per capita. This approach makes the data easier to compare with readers’ earnings and expenses.

According to a study commissioned by FOR in April 2016, more than 95% of Poles do not know the size of state spendings, and the vast majority are ignorant of their structure either.

Only 4% of respondents correctly estimated the state spending, 65% gave no answer at all, and 27% understated it at least twice. More than a quarter of them consider administrative expenditure as the largest part, while in reality it constitutes only 5% of the total, almost six times less than pensions, the real largest expense of the state.

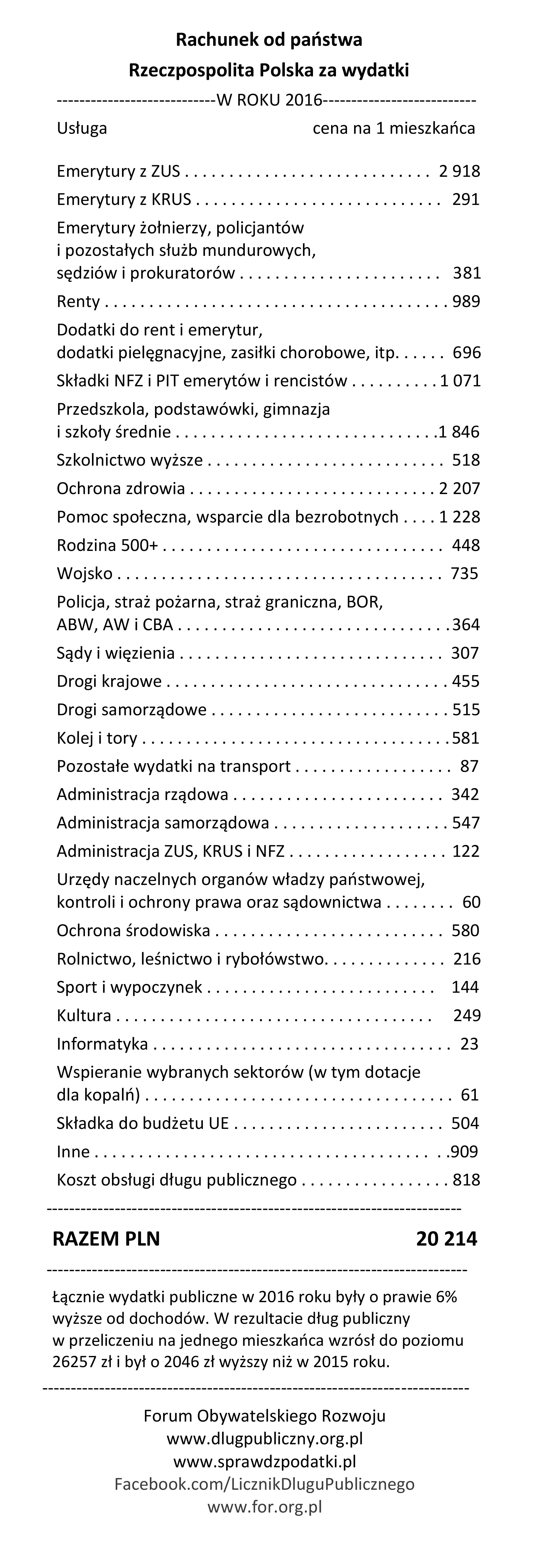

In 2016, the receipt from the state per capita amounted to 20 214 zł and was by 2 196 zł higher than six years ago when our project started.

Low public awareness of state expenditures has grave consequences for the country's political and economic life, especially in the election campaigns - for example, as there is no knowledge about pensions spendings, there is no widespread criticism of their further increases (due to lowering the retirement age and introducing 13th pensions). On the other hand, the belief that we spend so much on administration makes voters succumb to illusory slogans that expensive promises of politicians can be financed just by lowering administrative costs of the state.

In 2011, when we prepared the first edition of "The Receipt from the State," public expenditure per capita was 18,018 PLN.

A part of the increase (more than 820 zł) is due to rising prices, but the majority of it (almost 1400 zł) is a real increase in spendings. However, there exists a positive tendency for a gradual decline in the ratio of public expenditures to GDP - from 43.8% of GDP in 2011 to 41.2% of GDP in 2016, although unfortunately in 2016 it happened as a result of a decline in public investment.

On what does the government spend the most?

Pensions, education and health care together account for more than half of state spending. In 2016, the largest item in the receipt (per capita) were:

• Pensions - 6345 zł

• Education - 2365 zł

• Health care - 2207 zł

• Social assistance - PLN 1676 (including PLN 448 for the 500+ family program)

• Transport - 1638 zł

• Military, police, prisons, courts - 1407 zł

• Administration - 1072 zł

• Interest on public debt 818 zł

The biggest changes, as compared to the previous years, were caused by the introduction of the 500+ Family program, a decrease in debt servicing costs and a re-estimation of transport expenditures.

The 500+ Family Program was launched in April 2016 and only in 2017 will be fully visible in the "Receipt from the State." Expenses for transport are most likely overestimated - at the time of creation of the bill not all public service reports were yet known, but available data indicate that the investment plans have not been fully implemented. Debt servicing costs have been falling since 2013, which is due first of all to the grab of the open pension funds - the takeover of OFE funds in 2014, and secondly to low interest rates in the world economy.

State expenditures are not only expenditures of the state budget but also of local governments, NFZ (National Health Service), FUS (Social Insurance Fund) managed by ZUS (National Insurance Institution), KRUS (Agricultural Social Insurance Fund) and many other entities.

Although the vast majority of public spending falls on the units mentioned above, it is important to remember that the entire public finance sector covers more than 61,000 various institutions. In addition to the listed above, there are schools, universities, hospitals, but also such entities as municipal cemeteries, city parks, film studios "TOR," "ZEBRA," "KADR." As it is impossible to obtain data for all 61,000 entities and adjust the figures for the flows between them, the "bill from the state" contains one balancing item "Other."

"The Receipt from the State" deliberately presents the state's expenditure per citizen in a very simple way.

The amount of taxes and contributions paid by a particular person depends on how much she earns and what she buys. Our web page SprawdzPodatki.pl lets everyone check how much taxes and contributions are paid on the salary of a given amount. In addition, after entering an estimated size of his purchases, one can receive a personalized bill from the state.

Familiarity with the structure and size of state spending is essential as without it Polish citizens are unable to assess and verify irresponsible promises of politicians.

Updates and methodological changes

Updates to the previous bills result, on the one hand, from the publication of final data on the expenditures of Ministry of Finance, local governments, NFZ, ZUS, GUS (Central Statistical Office) and, on the other, from changes in our methodology. The receipts from the state are prepared in April when some of the institutions in the public finance sector have not yet published their final financial statements. Therefore, the version that we issue in Aprils is partly based on financial forecasts and plans that might not be realized. Updating the "Bills from the State" for 2011-2015, we have replaced previous estimates with the actual budgets of the individual units. Methodological novelties are twofold. First, Eurostat changed the methodology of national accounts from ESA95 to ESA2010, which altered the starting point of our calculations. Secondly, in the course of six years of working on the bill, we have been refining its structure towards greater clarity and transparency. During the updates, we applied the latest structure to all previous editions.

Prepared by: A. Łaszek

See also: Analysis 7/2017: Bill from the state: what are our taxes spent on?