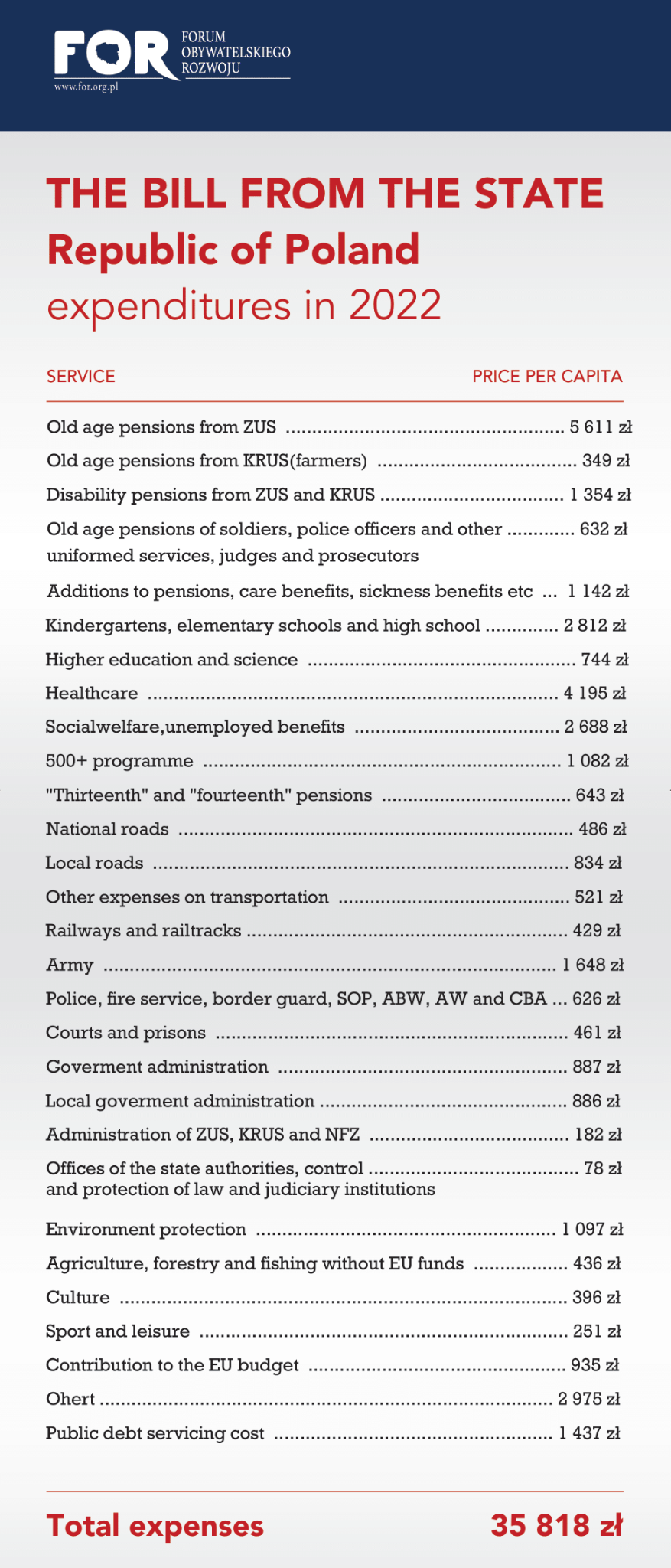

FOR Communication 13/2023: The Bill from the state for 2022

In 2022, public expenditure per capita amounted to almost 36,000 PLN, and per one working person - 79,381 PLN. All public spending is financed either by taxes we pay, or by government-issued debt (which means higher taxes in the future). Many people, demanding the implementation of further social programs by the state, do not realize that it is associated with higher taxation of the people (now or in the future). As Margaret Thatcher observed: “If the state wishes to spend more, it can do so only by borrowing your savings or by taxing you more. There is no such thing as public money, only taxpayers' money.

In 2022, public expenditure per capita amounted to almost 36,000 PLN, and per one working person - 79,381 PLN. All public spending is financed either by taxes we pay, or by government-issued debt (which means higher taxes in the future). Many people, demanding the implementation of further social programs by the state, do not realize that it is associated with higher taxation of the people (now or in the future). As Margaret Thatcher observed: “If the state wishes to spend more, it can do so only by borrowing your savings or by taxing you more. There is no such thing as public money, only taxpayers' money.

For the twelfth time, the Civil Development Forum has prepared the "Bill from the state", which shows the spending of the Polish state broken down into the most important categories and divided per capita. The "Bill from the state" includes all public expenditure, not only those recorded in the so-called state budget, which constitute only a part of the entire general government sector.

Growing opacity of public finances

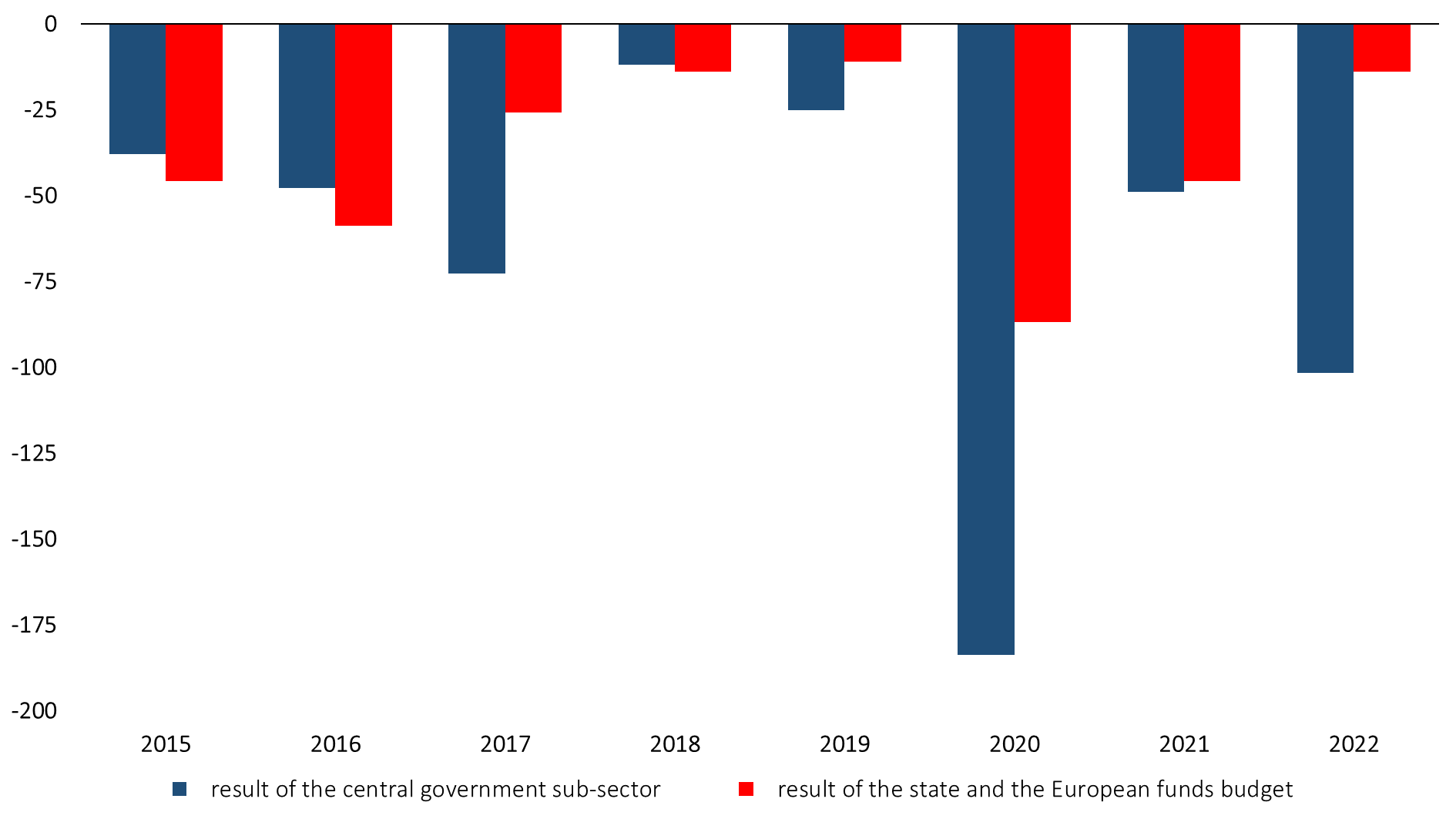

Especially in recent years, the state budget has been losing its position as the most important financial plan of the state. On the 7th of June, The Council of the Supreme Audit Office (NIK) for the first time in the history of the Third Republic of Poland did not grant a positive opinion on the government’s budget management, which is the result of pushing a large part of expenses, that should be implemented as part of the state budget, to off-budgetary funds at Bank Gospodarstwa Krajowego. By spending funds through BGK funds and using other tricks, the government is able to show any result in the state budget, which is regularly pointed out by the Supreme Audit Office in its audits.

Expenditures in BGK funds do not increase the state deficit, and, the debt incurred by BGK, although it is used to finance public tasks and is guaranteed by the State Treasury, does not increase the "state public debt", for which constitutional limits apply. In its opinion on government’s budget management, the Council of NIK alarms that in 2022 “the deficit of the state budget and the budget of European funds in total accounted for only 12.1% of the deficit of sub-sector of the government institutions. […] This means that the operations of this sub-sector were outside the state budget. Operations resulting in a deficit of more than six times the total deficit of the state budget and the budget of European funds”.

In addition, the NIK Council indicates that:

for three years, on an unprecedented scale, activities have been carried out which violate the basic budget principles, in particular transparency, unity, clarity and annuality of the budget. […] These activities not only affect the transparency of the presented data on public finances, but also prevent their comparison in subsequent years, and most importantly, they hinder parliamentary and social control over the collection and spending of public funds.

Chart 1. The result of the central government sub-sector and the state and the European funds budget

Source: Own study based on Eurostat and Ministry of Finance data

The full content of the publication can be found in the file to download below.

Contact to authors:

Marcin Zieliński, President & Chief Economist

[email protected]

Bartłomiej Jabrzyk, Analyst

[email protected]

Files to download