The Polish Tax System - it is Very Bad, but After Introducing the So-Called Polish Deal, it May Get Even Worse

Summary:

Summary:

-

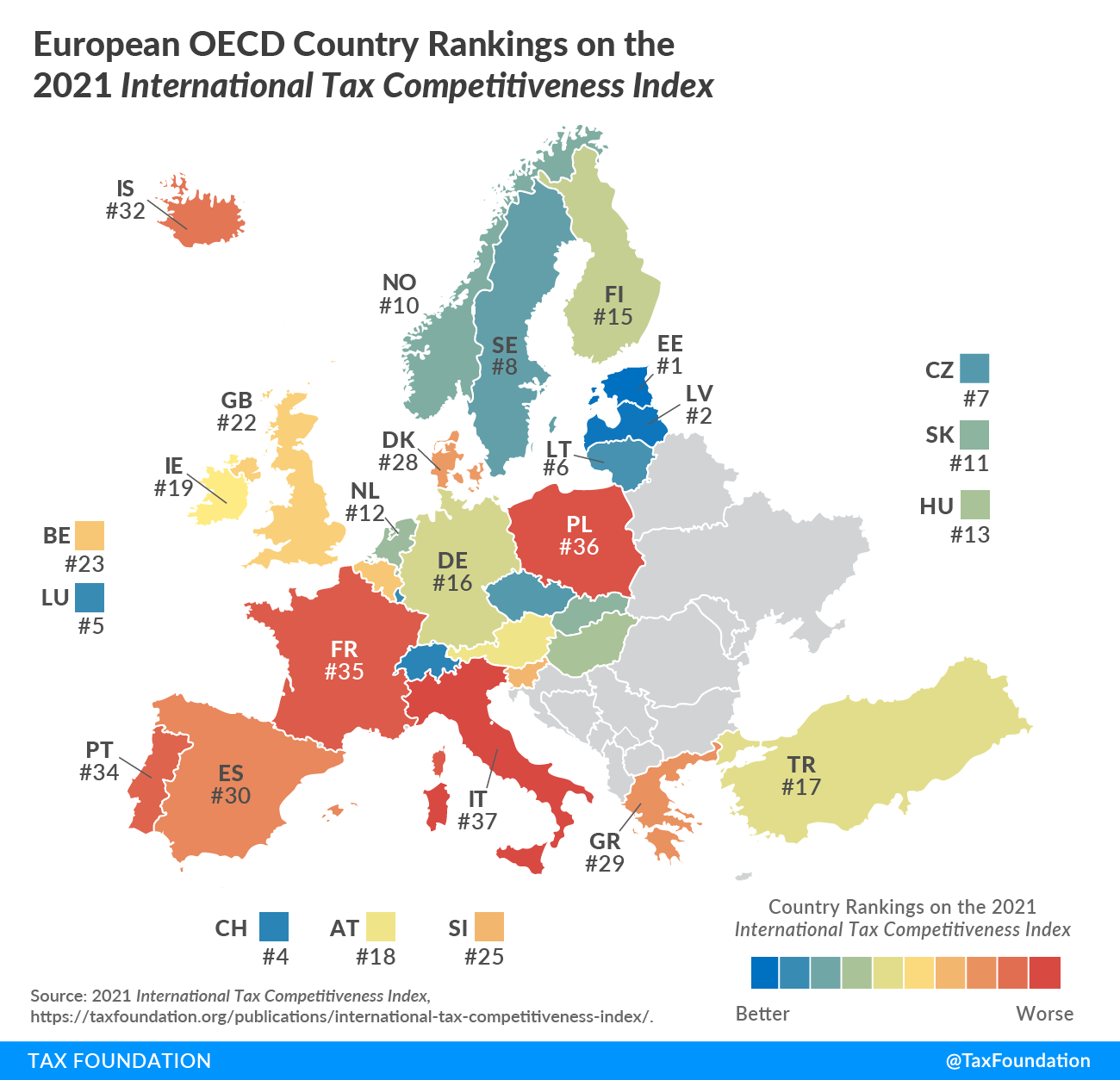

In the latest edition of the International Tax Competitiveness Index, Poland was placed penultimate out of 37 OECD countries. In the international ranking of tax systems' competitiveness prepared by the American Tax Foundation, only Italy scored worse. Poland maintained its position from last year and is three positions lower than two years ago.

-

The index measures the quality of the tax system in five areas: corporate taxation, personal taxation, consumption taxation, wealth taxation and rules for taxing cross-border activities. It takes into account not only the rates themselves (competitiveness) but also the complexity associated with numerous preferences and exceptions (neutrality).

-

The most significant problem of the Polish tax system turns out to be its complexity. Poland also performs poorly in terms of the tax base for consumption taxation, which is associated with the existence of a wide range of reduced VAT rates.

-

The index does not take into account an aspect which is particularly painful for Polish taxpayers, i.e. the volatility of regulations and uncertainty related to their enactment. Tax regulations in Poland are modified every now and then, which officially is often intended to "patch" loopholes. What is worse, in recent years it has become an infamous tradition to work at the end of the calendar year on tax and contribution changes which are to be effective as of 1 January of the following year.

-

This uncertainty is further increased by the work on the tax act, the so-called Polish Deal, which does not respond at all to the problem of excessive complexity of the Polish tax system identified by the Tax Foundation. The nearly 260-page amendment to the act does not give the impression of being uncomplicated, as indicated by tax advisors and tax law specialists.

Contact to author:

Marcin Zieliński, FOR Economist

[email protected]

Files to download