Communication 12/2017: Fuel charge - After a record increase in social spending, the government is looking for money in the pockets of taxpayers

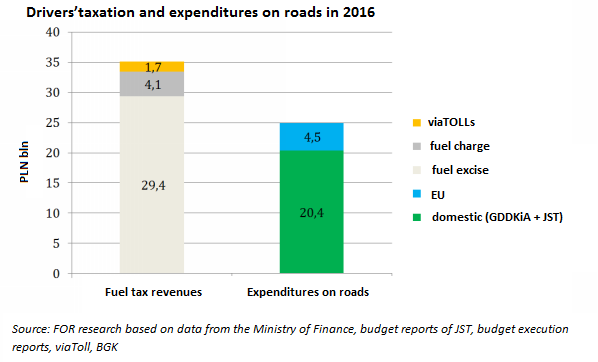

The government is announcing an increase in the fuel charge that will cost drivers an additional PLN 4-5 billion. The increase in tribute is not forced by road expenditures, but by the new social expenditures introduced by the government. In 2016, fuel tax revenues amounted to PLN 35 billion, compared with only PLN 20 billion spent on roads. The higher fuel charge is another tax that, in addition to rising public debt, is expected to finance the government's growing social spending. The increase in taxes is linked to the fact that Poland already has one of the highest deficits in the EU.

1. In 2016, taxation of drivers amounted to as much as PLN 35 billion, while state expenditures on roads amounted only to PLN 20 billion. The PLN 35 billion road tax includes fuel excise taxes, fuel charge, and tolls. We do not include VAT because all goods are subject to VAT and it is not a special road tax. However, it is worth remembering that this is a very cautious assumption - VAT is charged on the combined fuel price plus excise tax and fuel charge. PLN 20 billion of domestic expenses on roads was provided by GDDKiA and local authorities; this figure does not include an additional PLN 4.5 billion from the EU.

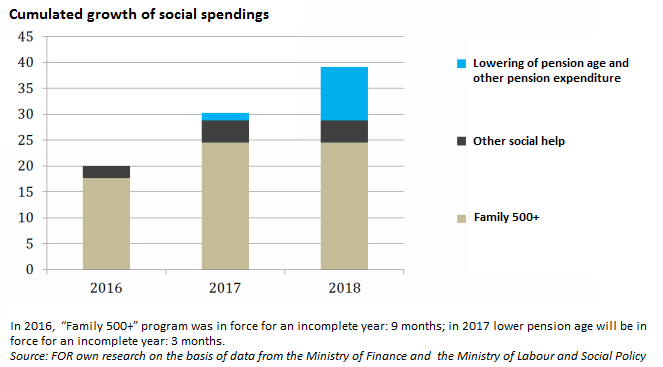

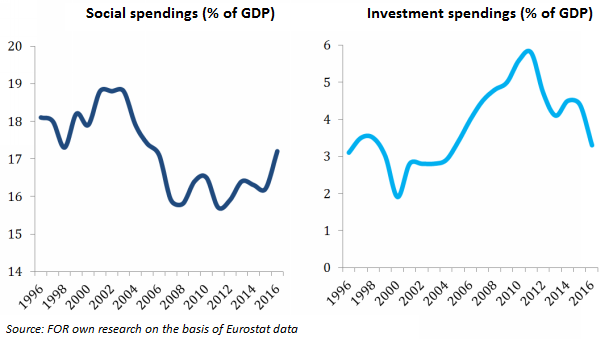

2. The government is increasing its social spending. In 2016, after record growth, Poland had the highest social spending since 2005 (17.2% of GDP). The full cost of the 500+ program will only be visible in 2017 (the full year of the program) and of the lowering the retirement age in 2018 (the full year it is in force.)

3. Up until now, the increase in social spending has not led to a deficit increase, as it was accompanied by a drop in investment spending (to its lowest level since 2004) and higher tax revenues thanks to good economic conditions. It is still too early to assess to what extent the increase in receipts from VAT is the result of a permanent sealing of the tax system rather than of good economic situation. However, the additional tax revenue is disproportionate to the government's planned increase in social spending and the rebound in public investment. At the same time, the deficit of the public finance sector is already negatively differentiating Poland from other EU countries.

4. As the further growth of public spending is planned, the government is looking for additional revenue. So far, a bank tax has been levied on the savings of Poles, the PIT thresholds were frozen (which effectively increases taxation), and VAT remains at an elevated level. At the same time, the government is still exploring new ideas for additional tributes, such as the introduction of excise taxes on e-cigarettes, the raising of the excise tax on beer, the introduction of a personal tax or the tightening of the television license fee.

5. Sources of data on driver taxation and road expenses

Fuel tax revenues include (1) fuel excise taxes, based on the data on MF revenues in the report on budgetary execution, (2) fuel charge, based on BGK 2015 annual report scaled up by nominal GDP growth for 2016, and (3) viaTOLL reported by the system. VAT is omitted.

Domestic road expenditures come from the implementation of the state budget (GDDKiA) and the execution of local budgets of local government. GDDKiA expenditures are financed from the National Road Fund and the state budget. JST's expenditures include national, provincial, district, city, and county public as well as internal roads. Expenditures from the EU include the KFD (revised plan for 2016 scaled by the ratio of the revised plan and the implementation of the KFD) and the self-government territorial units.

Terms used in text:

JST = self-government territorial units

GDDKiA = General Directorate for National Roads and Motorways

viaTOLLS = system of toll collection operating in Poland

BGK = Bank Gospodarstwa Krajowego, The State Development Bank of Poland

You are welcome to contact our experts:

Aleksander Łaszek - Chief Economist at FOR

[email protected]

Rafał Trzeciakowski - Economist at FOR

[email protected]

Files to download